child tax credit portal phone number

You will see the following screen on your computer. The amount you can get depends on how many children youve got and whether youre.

Taxes For Teachers And Educators Great Ways To Boost Your Tax Refund Https Youtu Be Ltbfards8wy Tax Refund Teachers Tax Money

The credit was made fully refundable.

. Sep 22 2021 Address Change for Letter 6419 If you submit a new address through the Child Tax Credit Update Portal the IRS will also use the updated address when it sends your year-end summary statement Mar 30 2020 Per the IRS website the office in Ogden Utah is. Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs. Do you have best practices to share.

If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you. The Child Tax Credit CTC provides financial support to families to help raise their children. Ill walk you through how.

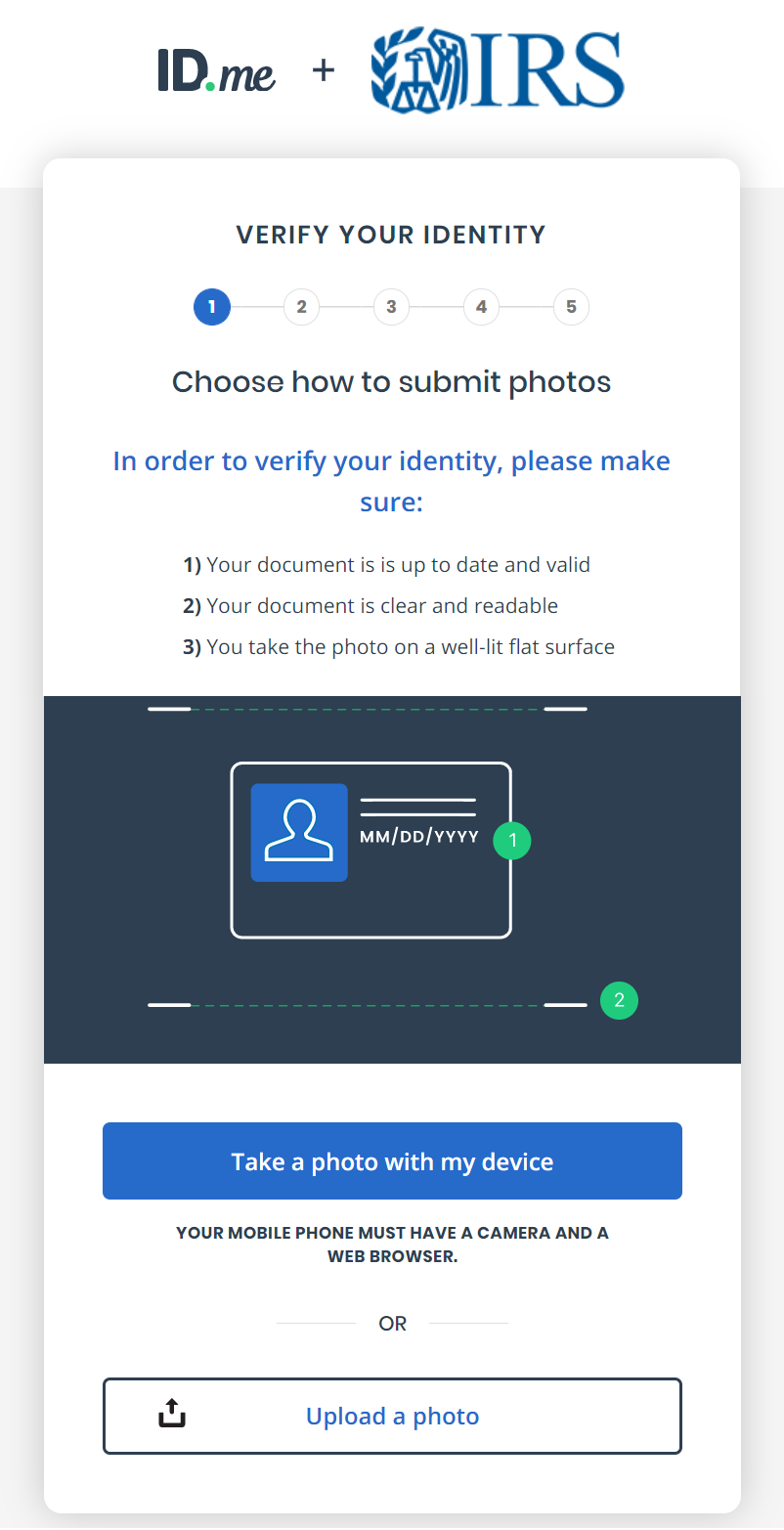

Upload your photos using your. Enter in your phone number and press the blue Continue button. Use our contact form to let us know.

Enter your information on Schedule 8812 Form. If you got advance payments of the CTC in 2021 file a tax. Closed weekends and bank holidays.

Creating an account for the CTC UP portal takes 20-30 minutes to complete if you have everything listed below. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. But there is a catch.

Choose the location nearest to you and select Make Appointment. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. So check all the.

Making a new claim for Child Tax Credit. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. The number to try is 1-800-829-1040.

This portal closes Tuesday April 19 at 1201 am. Already claiming Child Tax Credit. 44 2890 538 192.

Eligible families will receive advance ChildTaxCredit payments of up to 300 for each child younger than age 6 and up to 250 for each qualifying child ages six to. Check IRS Advance Child Tax Credit Update Portal 2022 at irsgov. By making the Child Tax Credit fully refundable low- income households will be.

Get your advance payments total and number of qualifying children in your online account. What other information is helpful for your refundable credit outreach education and tax preparation efforts. The Child Tax Credit Update Portal is no longer available.

Now through the Child Tax Credit Update Portal families can change the information the IRS has on file by updating the routing number and account number and indicating whether it is a savings or checking account according to a news release. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. Make sure you have.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. For more information see the Advance Child Tax Credit Payments in 2021 page on IRSgov. The Child Tax Credit provides money to support American families helping them make ends meet.

1-800-829-1040 Regardless of the state you live in the IRS representatives are available Monday through Friday between 7 AM and 7 PM your local time. Our phone line opening hours are. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

For assistance in Spanish call 800-829-1040. If you dont have internet access or cant use the online tool you can unenroll by contacting the IRS at the phone number on your Advance Child Tax Credit Outreach Letter you should have received from the IRS in June. If you want to log in to the IRS Advance Child Tax Credit Portal without the hassle of an IDme account I found a MUCH EASIER way.

You can also find out information in. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially increase your refund. The number to try is 1-800-829-1040.

Call the IRS about your child tax credit questions from the below phone number. The Child Tax Credit helps all families succeed. IRS Child Tax Credit Portal 2022 Login All the taxpayers are informed that IRS Child Tax Credit 2022 Portal complete information given on this page.

Check Out IRS Child Tax Credit 2021 Portal Tool Payment Calculator opt out Helpline Number from this page. Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. Child Tax Credit Update Portal to Close April 19.

If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional interpreters. Creating an account to access the Child Tax Credit Portal. What other materials and information would help you assist individuals and families who may qualify for EITC AOTC and the Additional Child Tax Credit.

Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming phone calls and not enough staff to deal with the procedural demands of. Find the total Child Tax Credit payments you received in your online account or in the Letter 6419 we mailed you. 1 day agoPlease include the vacancy announcement number in the subject line.

The first that your entire payment has to go to one account. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The credit amount was increased for 2021.

You need that information for your 2021 tax return. To reconcile advance payments on your 2021 return. Heres how to schedule a meeting.

File a 2021 tax return by April 18 2022 to claim the CTC for 2021.

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Pin By The Taxtalk On Income Tax In 2021 Capital Gain Capital Assets Investing

Website Design Delhi 7827751662 Website Designing Company India In 2021 Website Design Website Design Company Top Website Designs

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Let S Start With The Basics Of A Tax Return Filing Taxes Income Tax Tax Services

E Way Bills Portal Portal Portal Website Register Online

Provisional Itc Credit On Gst Portal ज एसट प र टल पर प र व शनल आईट स Tax Credits Portal Credits

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Register Associate Dsc Of Director Partner On Mca V3 Portal In 2022 Mca Director Association

Quicko Gst Tax Credits Tax Income Tax

Caonweb Is Providing An Important Calendar To Follow In April So Follow This Calendar And Avoid Penalties Bu Business Tax Important Dates Company Secretary

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back